(The second of three parts) (Part 1)

Haiti’s mineral wealth is still protected by a moratorium on mining activities imposed by the Haitian Senate five years ago, and a new mining law drafted in 2017 remains in a drawer somewhere. Nonetheless, tensions are rising between mining companies, the Haitian State, and civil society. For decades, many have salivated for the riches hidden in Haiti’s subsoil. Frustration is high. And in this uncertain climate, almost anything can happen.

Gold Companies Fight Each Other

Five years have passed since the Senate vote to curb the mining sector in Haiti. For companies, five years is too much, as evidenced by different meetings they’ve had with Haiti’s Office of Mines and Energy (BME), the many press releases they publish only in English, and the tense climate between them.

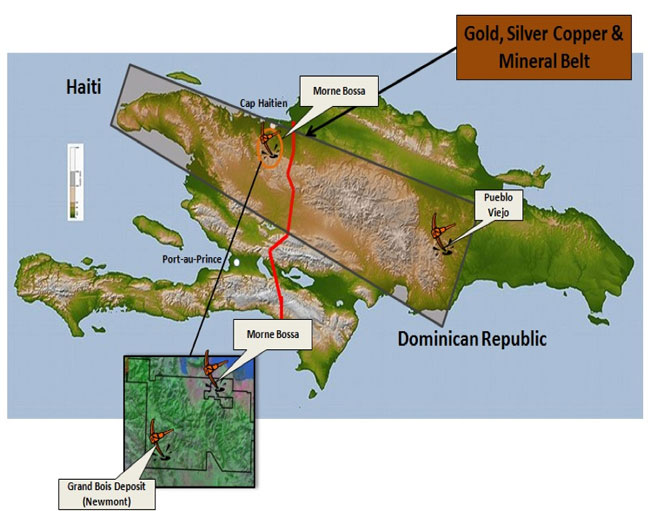

Behind these releases hide things unspoken, which are revealing, to say the least. The fact is that the companies involved in the mining projects in Haiti’s North and holding the exploitation licenses in Grand Bois and Morne Bossa are locked in battle, one year after the partnership agreements signed between them.

The Australian company 3D Resources Ltd. is in open conflict with the U.S. company Resource Générale Corporation (previously doing business as VCS Mining, Inc.) and its Haitian subsidiary Delta Société Minière S.A.. But it is also fighting with the U.S. company Sono Global Holdings Inc. (SGH) and its Haitian subsidiary Ayiti Gold Company S.A.. In July 2017, the 3D company bought 70% of the shares of the Grand Bois and Morne Bossa permits.

According to a Jun. 25, 2018 3D press release, the company terminated its agreements with VCS Mining Inc. and Sono Global Holdings Inc. with respect to these investments in Ayiti Resources S.A. and Delta Société Minière S.A., which hold the gold projects of Grand Bois and Morne Bossa respectively.

“This decision has been taken because of the lack of progress (…) due to the Company’s inability to obtain necessary permits to import equipment into Haiti to facilitate drilling (…) [It has] also been influenced by various conflicts that have arisen with the Company’s Haitian partners following the calling of force majeure,” continued the statement on the company’s website, in which it asked to be refunded and compensated for its losses.

Among other things, it mentioned, as reasons for termination, the delays in obtaining permits for the company that had planned a feasibility study for September 2018, but the moratorium taken by the Haitian Senate has not yet been lifted and the draft mining law has not yet been voted on.

Nevertheless, it is still interested in the case that “the proposed new Mining Act in Haiti is passed…”

According to the Resource Générale Corporation (RGC), 3D Resources is simply lying by publishing misleading and deceptive information. RGC claims that 3D is acting with the intention of devaluing the project and their assets. As a result, RGC accuses 3D of failing to comply with the agreements between the companies and of having violated the law on bribery in foreign transactions (US FCPA) and that there is no tolerance for conduct that does not respect the law in Haiti, the United States, or Australia.

The Foreign Corrupt Practices Act (FCPA) is a 1977 U.S. federal law to combat bribery of public officials abroad. This law has an international impact. We are talking about extraterritoriality. It covers all acts of corruption by companies or persons, U.S. or non-U.S., who are either located in the United States, or simply listed on the U.S. stock exchange, or who participate in some manner or other in a regulated financial market in the United States. It is implemented by the Office of Foreign Assets Control.

These are regulations which RGC and Sono Global Holdings Inc. say they are committed to follow.

“The management of RGC since its inception had concerns about the overall approach of the new parties / managers and its parent company, 3D Resources Ltd, called” The Manager “(…) [who] showed a lack management capacity, be it government relations or general operational management capabilities. (…) [It] had continually tried to operate outside the agreement and bypass the boards of local companies,” reads the statement.

RGC and its partner Sono, which represents 50% of the board members, have conducted an investigation revealing a series of wrongdoings that led to the termination of the contract with “the manager,” 3D.

According to the Resource Générale Corporation (RGC), 3D Resources is simply lying by publishing misleading and deceptive information.

These wrongdoings constitute serious misconduct that could have exposed businesses, their licenses, and some of the board members’ reputations, including, but not limited to, local community members, to significant risk.

However, the parties are supposed to still be discussing whether they should restructure the agreements under which they would develop the Grand Bois and Morne Bossa projects. This seems contradictory since they are also talking about termination of contracts.

The most recent press release of RGC (previously VCS Mining) no longer speaks directly of 3D Resources. The company urges any company that comes to Haiti to work in this sector to respect the laws of the country in the same way that it would respect the laws of their own country. But it also congratulates the BME for the drafting the mining bill and Haiti’s Senate, rather prematurely, for its unanimous acceptance.

[Update: On Oct. 16, 2018, 3D Resources Ltd. issued a press release announcing that it was taking “effective control” and “100% ownership” of the Grand Bois and Morne Bossa projects from RGC and SGH by forming “a wholly owned subsidiary” Haiti Gold Aust Pty. Ltd. (HGA) which “has executed a new acquisition agreement that, subject to completion of conditions precedent, secures the Company’s gold projects in Haiti.”

It says that RGC and SGH “will receive a 25% Net Profit Interest, thereby providing much the same level of financial return to the Haitian partners.” But 3D would be running the show through its “Haitian” subsidiary HGA, if certain conditions are met. In short, 3D Resources proposes that “HGA acquires 100% ownership of the two Haitian Companies: Ayiti Gold Company S.A, which holds the Grand Bois project, and Delta Societe Miniere S.A, which holds Morne Bossa project. It will also acquire a British Virgin Island holding company Haiti Gold (BVI) Inc.”

The Australian company’s optimism is fueled by the arrival of Jean-Henry Céant in the post of Prime Minister. “Recently (within the last month) Haiti appointed a new Prime Minister who has expressed his support for the mining industry and placed the new Mining legislation on the agenda for implementation by his government,” wrote 3D Resources in its note. “The Company is therefore optimistic that it will be able to resume mining activity at its Haitian gold projects in the near term…”

There has been no reaction yet from RGC and SGH or their “Haitian” partners, Ayiti Resources S.A. and Delta Société Minière S.A.. Nor has the Haitian government made any statement about 3D Resources’ announcement. – HL]

(To be continued in Part 3)

Translated from the original French by Kim Ives